claim workers comp taxes

Under most normal circumstances workers compensation payments are tax-free income for disabled individuals who are unable to work on a temporary or permanent basis. In fact IRS publication 907 states in pertinent part.

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements.

. Do you receive retirement income. If your SSDI is decreased by 300 a month and replaced with 300 in workers compensation income 300 of your workmens comp is taxable. Do I have to Pay Taxes on Workers Comp Benefits.

In other words the workers compensation insurance payments must comply with state law in order to avoid taxes. First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS. Ad No Money To Pay IRS Back Tax.

Recent Internal Revenue Service IRS rules state. It makes sense that workers compensation benefits are not taxed. If your tax adviser wants to know the amount you can explain that the benefits are not.

For 2021 the amount is increased. Usually workers compensation benefits will not affect your tax return. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers.

Piscataway Workers Compensation Lawyer Experienced Workers Comp Attorneys Represent Injured Employees in Piscataway NJ. The attorneys of Bramnick Rodriguez Grabas Arnold Mangan LLC. He received the Order of Service award from the North Carolina.

Lump sum settlements from workers compensation cases do not count as taxable income either. The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employees income through a dependent care assistance program. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax issues. Generally workers compensation benefits are not considered income and therefore are not subject to taxes. The WCC address is.

No workers compensation benefits are not taxable at either the federal or the state level theyre generally payable at 23 of what. Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. Workers Comp Is Generally Tax Exempt.

Ad No Money To Pay IRS Back Tax. Pennsylvania Lawyers For Workers Compensation Claims. About the Author.

Workers compensation benefits are not taxable and are not claimed on yearly tax statements. And those who dont yet receive workers comp may wonder if theyll owe the IRS pending. From IRSs Publication 525.

Most workers compensation benefits are not taxable at the state or federal levels. These are fully exempt from state and federal taxes regardless if paid on a scheduled. Yes you can but you dont always have to.

Workers compensation benefits are generally not taxable by the Internal Revenue Service IRS. May 31 2019 443 PM. With tax reform in the headlines you may be asking whether you need to pay taxes on workers comp benefits.

The following payments are not taxable. Since they are already based on two-thirds of your wages it would be. The quick answer is that generally workers compensation benefits are not.

Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin. Internal Revenue Service Workers Compensation Center 400 North 8th Street Box 78 Richmond VA 23219-4838. However a portion of your workers comp benefits may be taxed if you also receive Social Security.

Do you claim workers comp on taxes the answer is no. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation. Apply to Claims Representative Claims Adjuster Human Resources Assistant and more.

In Massachusetts that statute is the Workers Compensation Act WCA also known as. However the government does not look at workers comp in the same way that it looks at actual wages earned. As the IRS publication on taxable and nontaxable.

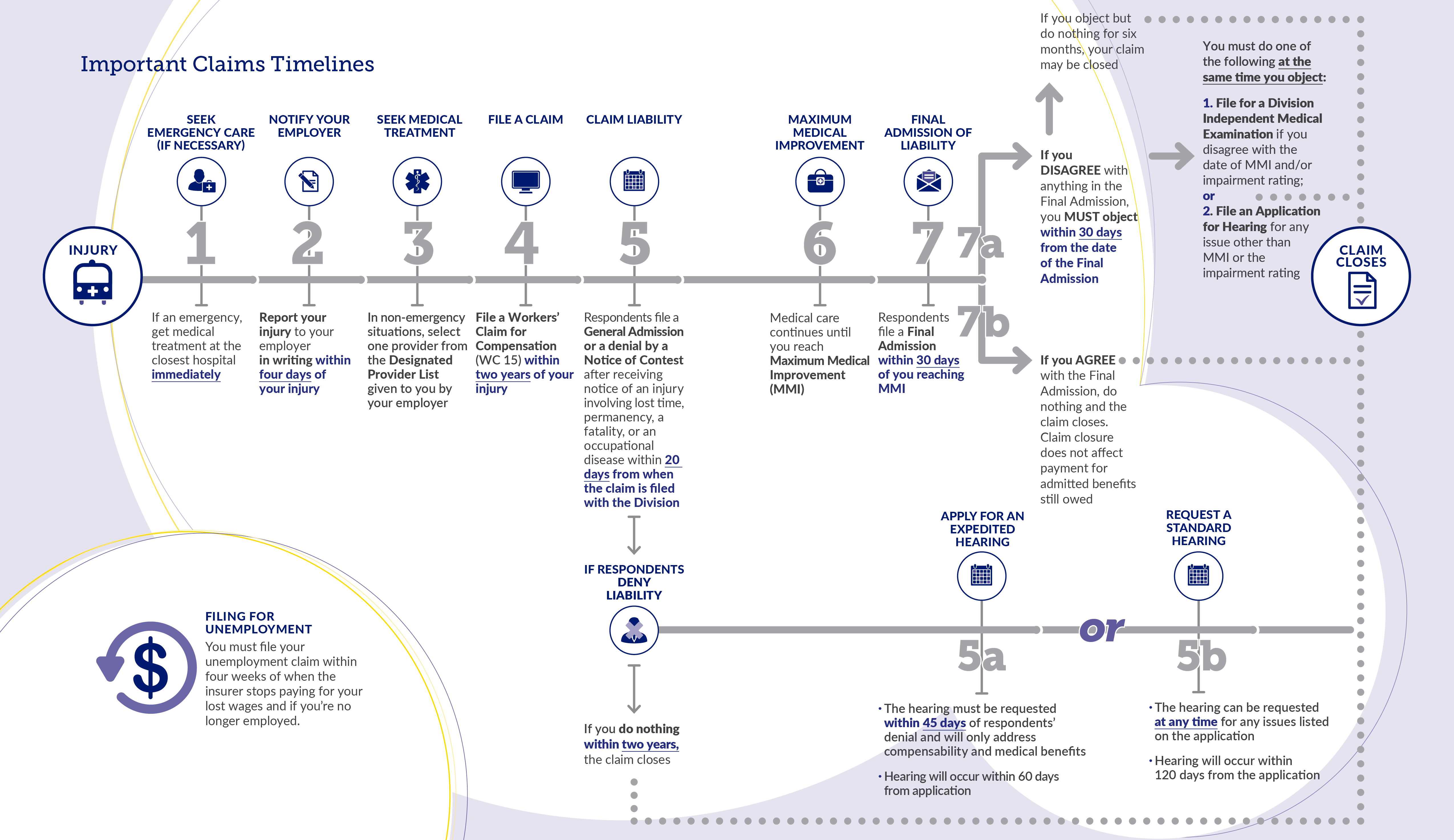

The injury claim must be completed and transmitted by. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. If an insurer is.

Is Workers Compensation Taxable Klezmer Maudlin Pc

Workers Compensation And Taxes James Scott Farrin

Are My Workers Comp Benefits Taxable In Massachusetts

6 800 1 Workers Compensation Program Internal Revenue Service

Are Workers Compensation Settlements Taxed In Montana

Are The Benefits From Workers Compensation Taxable In Texas D Miller

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation And Taxes James Scott Farrin

How To Deduct Workers Compensation From Federal Tax Form 1040

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Will My Workers Comp Benefits Be Taxed In California

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

File A Workers Compensation Claim Department Of Labor Employment

Are My Vermont Workers Compensation Benefits Taxed

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Is Workers Compensation Taxable Klezmer Maudlin Pc

Do I Have To Pay Taxes On My Workers Comp Benefits

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump